Unker Anon,

Sorry was in a rush this morning. :D

Firstly, its earnings.

I'm kinda confused cos i had a glance at OSK write-up.

So I decided to look back at Bursa website.

This is Maxtral's Q1 earnings.

Quarterly rpt on consolidated results for the financial period ended 31/3/2006

net profit reported: 3.707 million

This is Maxtral's Q2 earnings.

Quarterly rpt on consolidated results for the financial period ended 30/6/2006

net profit reported: 3.053 million.

This is Maxtral's Q3 earnings.

Quarterly rpt on consolidated results for the financial period ended 30/9/2006

net profit reported: 3.470.

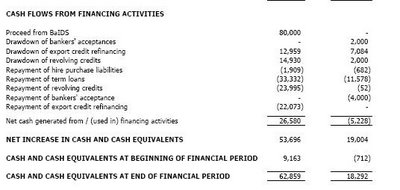

If you add up the numbers, its net profits shows 10.230 million only. But if you look at what Maxtral is saying, its ytd 3 quarter net profit is at 14.559 million.

How?

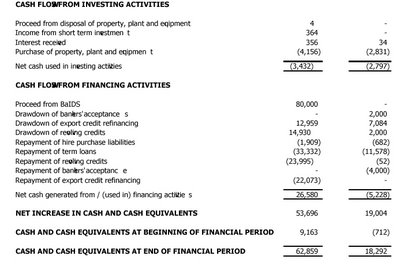

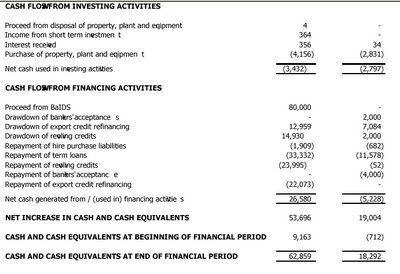

I think the later is correct because the cash flow is much, much stronger than Maxtral's earnings of 10.230 million. So what i am saying is i believe Maxtral's Q3 net earnings is much more than stated. I believe it's a typo, perhaps.

I took a screen-shot of Maxtral's earnings (look at the circle). OSK is saying that according to Maxtral data, its Q3 net earings is 7.8 million. (which kinda tally with Maxtral's cash flow, cos this quarter, Maxtral's cash flow increased by some 14+ million!)

Now regarding them dilution effects again.

Remember i wrote the following....

>>>>

1. Them preference shares issue. See Maxtral posting.

- At the moment of writing, Maxtral has some 210.099 million shares and it has some 84.415 million shares of ICUL outstanding. (ICP can converted on 1-1 basis)

Which means that if one ass-u-me full conversion of these ICP shares, then Maxtral should have 294.514 million shares. That should the share base you probably should work upon to avoid any shocks from discovering that your earnings per share has been diluted by these ICP shares. Ass-u-me the worse case scenerio. That's what I would have done. Remember this is just a mere second opinion. Some would probably have a different approach depending on one's investing style. For example, some would dare just the current share base (210.099 mil shares) cos they do not reckon that they would be such a long term investor. Which is right or wrong, it depends on your own interpretation.

>>>

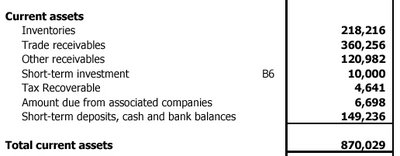

So if you have a look at Max's earnings, its Q3 earnings states that its net earnings came in at 14.979 million.

Now assuming this figure is correct.. then this company is churning out some 4.993 million per quarter or as they say, if u annualise on a yearly basis, that's close to 20 million in earnings.

Using the fully-diluted number of shares - ie assuming full conversion of ICP, then the earnings per share is 20 million divided by 294 which gives you roughly an earnings per share of 6.8 sen.

So if you use this diluted earnings per share number, i think you should be ok lah.

PS..

regarding the mp player. BUY the IPOD nano unker. Your kids been good and they deserve a grand christmas present!

:D