Posted 30th Aug 2010: Oh, that stock called QL

Firstly the nice chart of QL. It flew didn't it? :=)

QL reported its earnings last night. Here's the quick numbers.

How?

Earnings growth still there but the balance sheet issues mentioned earlier in the posting Oh, that stock called QL still prevails.

Let me reproduce that posting in full here......

-----------------

Dedicated to BB.

- bullbear said...

Financial Datas on QL: here

QL is yet another company with good revenues (8% annually) and earnings growth (>20% annually). Its ROA was around 9% to 10% and with judicious leverage through debt and borrowings, its ROE was around 21% to 22%.

At its present price, its PE is at its higher end of its historical range. The company has been selling its treasury shares recently. Of course, QL hogs the limelight with its recent purchase of Lay Hong.

Yes, QL is one of the stocks which had an incredible growth and the stock markets, they tend to really love them growth stocks to the death and yes, there are some who believe that growth is one of them market holy grails. Yeah, what's your holy grail? Mine? My flawed view of course is not being stupid and silly and needless to say, knowing when I am the silly jackass should be sufficient enough to make great money.

The charts - charts are not bad a tool for the kiasu leh. You know a stock market kiasu player is one who does not want to be in a stock when the stock is at its peak. Yeah, buying high and selling higher does not exist in their world. :P.

And this is how QL - the stock has performed since 2002. (Chart is provided by Chartnexus.com and it's price adjusted to account for all the bonus and splits. Hey if it's inaccurate - don't shoot me on this issue! :P )

The financial track record.

The earnings growth is clearly there to be seen.

Some 'purist' - they love to be precise and they like to use stuff like CAGR to check out the growth.

Let's have some fun. :P

Using ttm earnings of 111.673 as the end number.

1. Since 2002 or a time span of 9 years, QL's earnings had a CAGR of 22.33%!

2. But since 2006 or a time span of 5 years, QL's earnings had a CAGR of only 18.01%

Yeah.. as mentioned once before in the blog, the starting point of reference is always crucial and sometimes when one 'handpicks' the starting the point, the CAGR numbers could look seriously impressive. :D

But then... the purist would insist that that simple result is rather significant because it does indicated the growth rate is slowing the most recent 5 years compared to the last 9 years. And there's probably some sort of logic here because growth rate does not last forever and ever and especially for a company's earnings, growth could simply 'peak'.

And yeah.. for the stock market, there's so many approaches and there's so many different techniques and no, I do not think it's a sin if one misses out on a so-called opportunity because they feel that they are uncomfortable with the strategy.

And of course, there are some, who have noted the rather 'thin' margins for QL Resources.

Would this be an issue? For some yes. For some no. As long as the growth remains strong, the 'thinner' margins are acceptable.

And for some, those numbers alone are not sufficient.

Well if the above passes one's test, one would probably want to know what's the driving factor. Yes, if one does 'more' research, QL is a diversified company and it would make sense to have a look at the company's segmentals.

As indicated, marine-based manufacturing and integrated livestock farming are the driving factor behind QL's current success and if one is really interested in this company, it would be sensible to understand more, yes? Yes, do spend some time researching.

Wah.. some smart ass would say 'Walaueh! so much work to do meh? Much easier if the just follow a stock tip and punt on it!

Very true. :D

Of course, it's much easier.

I don't deny it but I for one, like to 'invest' in a stock from a business perspective. That is, I only invest or be a business partner in the stock ONLY when I fully understand what's happening.

Seriously. Say Auntie Susan comes to you and ask if you are interested in joing her in a business ventrue to open a toe massage center. Would you just say yes, because it's Auntie Susan (:P) or would you take the time and do some careful research? Well if the answer is the latter, then why is investing in a stock any different?

Now assume one has done the research ( LOL! I am lazy to do the research! :P) and one is satisfied, then perhaps one should look at the company's balance sheet.

Yes, sometimes to read that a company's making money, is simply not enough.

Remember Megan Media issue? Company at one time kept saying there's profit, lot's of profits but its debts and receivables kept on growing at insane rate. Well not insinuating anything but just saying that it's much better to know a bit more than not knowing anything at all. :P

The Balance Sheet.

How?

Clearly the balance sheet is NOT as nice as the company's earnings.

The clear debt build up is very clear.

But some would argue that cash recently has 'grown'...

Now this is QL's Q4 earnings reported on May 2010: Quarterly rpt on consolidated results for the financial period ended 31/3/2010. Open the Excel file attached and look for the Cash Flow statement. Do you like what you see?

I am sorry but I don't.

As mentioned in a discussion back in 2007, "there is no breakdown of how and where the money went... see how everything is just lumped as investing activities? So what's the investing activities? " And what's the financing activities?

Yes, I do feel QL ranks poorly in the issue of being transparent in its disclosure of it's cash flow!

The cash flow is so important to the investing public. The investing public needs to know where the money is coming from and it needs to know where the money is flowing out!

To not explain is not respecting the investing public at all!

hehe... these comments are as it is. It's my flawed thinking and if you think I am wrong, then I am wrong. My opinions are a dime a dozen. :D ( LOL! Some say 'Talk is cheap because supply more than demand! :P )

So how?

The most recent fiscal year, cash balances 'improved' to 106.112 million. Surely this is impressive, yes?

But... but.... butttt.....

The cynical would also be quick to point out that DEBTS as 'improved' to a whopping to 412.330 million!

How?

Perhaps the cash balances 'improved' because of a drawdown in the company's borrowings.

Not possible?

Yeah... how unfortunate that QL does NOT want to disclose properly what's happening in their cash flow statement. :(

And the numbers 'purist' would be quick to draw out their financial calculators and compute the CAGR of QL's debts!!!!

In 2002, QL's debts was 156.240. 9 years later, the debt is now 401.424 (and as the earnings CAGR, the ttm numbers is used as the 9th year). And the debt CAGR is some 11.05%.

Now for some, this is acceptable because the earnings growth rate was some 22.33% ( see earlier part of this posting).

But for some, such debt build up is a no-no.

And for some, it's way too complicated. :P

Here's perhaps a more simplier perspective.

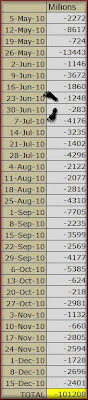

Now if one sums up the earnings since fy 2002, one can see that since 2002, QL has earned some 601.407 million.

Nice.

But at fy 2002, using the simplistic net cash approach (net cash = total cash - total debts) , one saw that QL was in a net debt of 136.727 million.

Now remember, since fy 2002, QL resources had earned some 601.407 million.

Now as a businessman or business lady, what do you want to see?

Don't you want to see the company is able to generate some sort of wealth from this 601.407 million?

And in terms of wealth, won't it be logical that the company's net cash position improve?

601.407 million woh!

And how did QL's most recent quarter earnings showed? Total cash stands at 70.720 million. Total debts is at 401.424 million! Or a net debt of 330.704 million!

As stated in a discussion back in 2007, "So the issue is simple. As an investor, one probably should be weary that the company is not able to retain some sort of wealth from all the earnings it had earned."

Ah... but some would insist that such a perspective is flawed. :D

How?

ps: If u ask me, I would suggest you asking BB. He's the expert. Not me. :D

ps: LOL! The Star Biz have an article on QL: Is QL Resources in for more M&As?

Disclaimer

1. I am a nobody.

2. I am not responsible for anyone's investments.

3. I am not a sotong. :D

4. I am certainly not an independent investment advisor.

5. Since I am not an in dependant investment advisor, I cannot guarantee that you should lose money.

6. Most important, I find no motivation to talk about stock price movements. Yeah, I do not indulge in guessing what a stock price will or will not do. So please spare me all the chats that you think this stock will go down by so much or this stock will soar by so much.